Martin Stone, Spencer Strauss9780793161294, 0-7931-6129-0

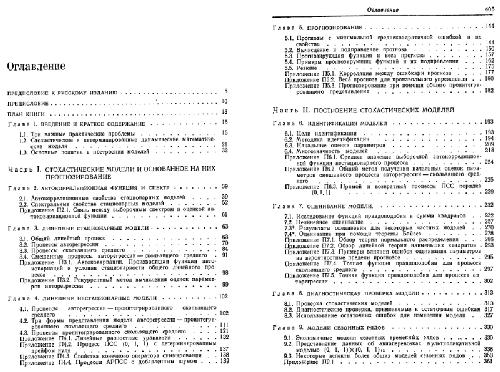

Table of contents :

Cover……Page 1

CONTENTS……Page 6

Preface……Page 10

Acknowledgments……Page 16

1.RETIREMENT REALITIES……Page 18

Time Costs Money……Page 19

The Stats Don’t Lie……Page 20

Inf lation: Friend or Foe?……Page 21

Inf lation and the Fixed Income……Page 23

The Tax Man Cometh……Page 26

Social Security……Page 27

401(k)s……Page 29

Health Insurance and Related Needs……Page 30

Life Expectancy……Page 32

2.GREAT EXPECTATIONS……Page 34

Focus Up……Page 35

Finding Balance……Page 36

Three Steps……Page 37

Determining Net Worth……Page 39

Assets versus Liabilities……Page 40

Spending Habits……Page 41

Back to the Future……Page 44

Dream a Little Dream……Page 47

Striking It Rich……Page 50

Three Groups of Investors……Page 51

Group #1: “Got Plenty of Time”……Page 52

Group #2: “Too Busy Just Hangin’ On”……Page 56

Group #3: “Worried It May Be Too Late”……Page 59

4.THE APPRECTION GAME……Page 68

Real-Life Comparable Property Sale from 1977……Page 69

Proof in the Pudding……Page 75

Your Yellow Brick Road……Page 78

The Five-Point Plan……Page 79

Step One: Learn……Page 80

Step Two: Research……Page 81

Step Three: Plan……Page 82

Step Four: Invest……Page 83

Step Five: Manage……Page 84

5.COMPONENTS OF RETURN……Page 86

The Income……Page 87

The Expenses……Page 88

Loan Reduction……Page 90

Appreciation……Page 91

Tax Benefits……Page 94

Modified Accelerated Cost Recovery System (MACRS)……Page 95

Putting It All Together……Page 99

Your Winning Numbers……Page 102

Sharing the Secrets……Page 103

Goals……Page 107

Cash-Flow Requirements……Page 108

Tax Benefits……Page 109

Cash Withdrawal……Page 110

The General Plan……Page 111

The Detailed Plan……Page 115

Follow-Up and Goal Review……Page 119

7.TAX PLANNING……Page 122

Deductions as an Owner……Page 123

Operating Expenses……Page 124

Capital Expenses……Page 125

The Depreciation Allowance……Page 126

Capital Gains……Page 127

The 1031 Tax-Deferred Exchange……Page 129

Types of 1031 Exchanges……Page 130

The Installment Sale……Page 134

Refinancing……Page 138

8.APPRAISING VALUE……Page 140

Methods of Valuing Property……Page 141

Comparative Market Analysis……Page 142

Reproduction Cost Approach……Page 145

Capitalization of Income……Page 146

The Gross Scheduled Income……Page 148

Expenses……Page 149

The Cap Rate……Page 150

To Sum Up……Page 151

The Gross Rent Multiplier……Page 152

Finding Hidden Value……Page 153

The Highest and Best Use……Page 155

9.FINANCING REAL ESTATE……Page 158

Costs of Borrowing……Page 159

Three Sources of Money……Page 160

Government Lending……Page 161

Conventional Loans……Page 163

Residential Loans: One to Four Units……Page 164

Commercial Loans: Five Units and Up……Page 165

Fixed Loans……Page 166

Private-Party Financing……Page 171

To Sum Up……Page 172

10.MINDING THE FARM……Page 174

Open for Business……Page 175

HUD Housing……Page 178

Discrimination……Page 180

Utilities and Insurance……Page 181

Who’s Doing What?……Page 182

Determining Vacancy Rates……Page 183

Determining Rental Rates……Page 184

Filling a Vacancy……Page 185

A Policy on Pets……Page 187

Happy Tenants……Page 188

Raising the Rent……Page 189

Conclusion……Page 192

Appendix……Page 196

Glossary……Page 210

Recommended Reading……Page 216

Index……Page 218

About the Authors……Page 222

Reviews

There are no reviews yet.