Stephen Satchell075068321X, 978-0-7506-8321-0

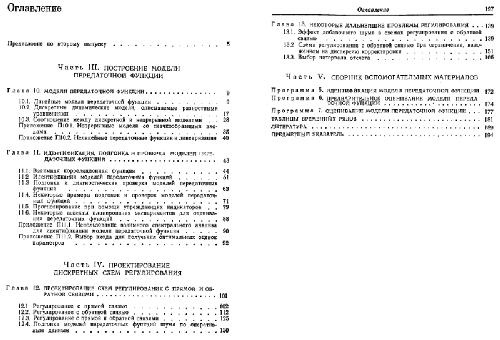

Table of contents :

Table of Contents……Page 3

1.1 Introduction……Page 10

1.2 A modern view of market efficiency and predictability……Page 11

1.3 Weak-form predictability……Page 12

1.4 Semi-strong form predictability……Page 14

1.5 Methodological issues……Page 17

1.6 Perspective……Page 19

References……Page 21

2.1 Introduction……Page 25

2.2 Expected returns……Page 26

2.3 The Black–Litterman model……Page 29

2.4 A new method for incorporating user-specified confidence levels……Page 40

2.5 Conclusion……Page 44

References……Page 45

3.1 Introduction……Page 47

3.2 Workings of the model……Page 48

3.3 Examples……Page 50

3.4 Alternative formulations……Page 54

Appendix……Page 58

References……Page 61

4.1 Introduction……Page 62

4.2 Efficient portfolios……Page 65

4.3 Optimal portfolios……Page 77

4.4 A variety of sorts……Page 84

4.5 Empirical tests……Page 89

4.6 Conclusion……Page 102

Appendix A……Page 103

Appendix B……Page 104

References……Page 106

5.1 Introduction……Page 108

5.2 Linear factor models……Page 111

5.3 Approximating risk with a mixture of normals……Page 113

5.4 Practical problems in the model-building process……Page 115

5.5 Optimization with non-normal return expectations……Page 119

References……Page 122

6.1 Introduction……Page 124

6.2 Derivation of the prior and posterior densities……Page 126

6.3 Numerical evaluation……Page 138

6.4 Results……Page 141

6.5 Concluding remarks and issues for further research……Page 147

Appendix……Page 149

References……Page 155

7.1 Introduction……Page 158

7.2 A classical framework for option pricing……Page 162

7.3 A Bayesian framework for option pricing……Page 163

7.4 Empirical implementation……Page 170

7.5 Conclusion……Page 179

Appendix……Page 180

References……Page 181

8.1 Introduction……Page 183

8.2 Notions of robustness……Page 184

8.3 Case study: an implementation of robustness via forecast errors and quadratic constraints……Page 188

8.4 Extensions to the theory……Page 190

8.5 Conclusion……Page 193

References……Page 194

9.1 Introduction……Page 196

9.2 Hypotheses and calculating factors……Page 198

9.3 Empirical results……Page 201

9.4 Conclusions……Page 216

References……Page 217

10.1 The information coefficient and information decay……Page 219

10.2 Returns and information decay in the single model case……Page 221

10.3 Model combination……Page 225

10.4 Information decay in models……Page 226

10.5 Models – optimal horizon, aggression and model combination……Page 228

Reference……Page 230

11.1 Introduction……Page 231

11.2 Analysis of the single model problem……Page 232

11.3 Closed-form solutions……Page 236

11.4 Multi-model horizon framework……Page 240

11.5 An alternative formulation of the multi-model problem……Page 245

11.6 Conclusions……Page 247

Appendix A……Page 248

Appendix B……Page 250

References……Page 254

12.1 Introduction……Page 255

12.2 Actual versus risk-neutral probabilities……Page 256

12.3 Replicating investments with bets……Page 259

12.4 Log optimal (Kelly) betting……Page 260

12.5 Replicating Kelly bets with puts and calls……Page 262

12.6 Options on Kelly bets……Page 263

12.7 Conclusion……Page 264

References……Page 265

13.1 Introduction……Page 268

13.2 General set-up……Page 269

13.3 Power utility……Page 274

13.4 Exponential utility, loss aversion and mixed equilibria……Page 279

13.5 Conclusions……Page 280

References……Page 281

Index……Page 283

Reviews

There are no reviews yet.