Daniel Straumann (auth.)9783540211358, 3-540-21135-7

This monograph concentrates on mathematical statistical problems associated with fitting conditionally heteroscedastic time series models to data. This includes the classical statistical issues of consistency and limiting distribution of estimators. Particular attention is addressed to (quasi) maximum likelihood estimation and misspecified models, along to phenomena due to heavy-tailed innovations. The used methods are based on techniques applied to the analysis of stochastic recurrence equations. Proofs and arguments are given wherever possible in full mathematical rigour. Moreover, the theory is illustrated by examples and simulation studies.

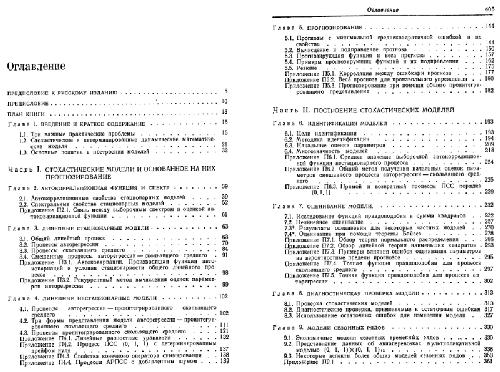

Table of contents :

Introduction….Pages 1-12

Some Mathematical Tools….Pages 13-36

Financial Time Series: Facts and Models….Pages 37-62

Parameter Estimation: An Overview….Pages 63-83

Quasi Maximum Likelihood Estimation in Conditionally Heteroscedastic Time Series Models: A Stochastic Recurrence Equations Approach….Pages 85-140

Maximum Likelihood Estimation in Conditionally Heteroscedastic Time Series Models….Pages 141-168

Quasi Maximum Likelihood Estimation in a Generalized Conditionally Heteroscedastic Time Series Model with Heavy—tailed Innovations….Pages 169-186

Whittle Estimation in a Heavy—tailed GARCH(1,1) Model….Pages 187-213

Reviews

There are no reviews yet.