Ser-Huang Poon0470856130, 9780470856130, 9780470856154

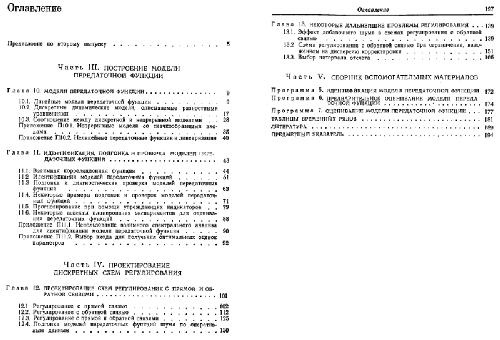

Table of contents :

A Practical Guide to Forecasting Financial Market Volatility……Page 4

Contents……Page 10

Foreword by Clive Granger……Page 16

Preface……Page 18

1.1 What is volatility?……Page 20

1.2 Financial market stylized facts……Page 22

1.3 Volatility estimation……Page 29

1.3.1 Using squared return as a proxy for daily volatility……Page 30

1.3.2 Using the high–low measure to proxy volatility……Page 31

1.3.3 Realized volatility, quadratic variation and jumps……Page 33

1.3.4 Scaling and actual volatility……Page 35

1.4 The treatment of large numbers……Page 36

2.1 The form of X(t)……Page 40

2.2 Error statistics and the form of ε(t)……Page 42

2.3 Comparing forecast errors of different models……Page 43

2.3.1 Diebold and Mariano’s asymptotic test……Page 45

2.3.3 Diebold and Mariano’s Wilcoxon sign-rank test……Page 46

2.4 Regression-based forecast efficiency and orthogonality test……Page 47

2.5 Other issues in forecast evaluation……Page 49

3.1 Modelling issues……Page 50

3.2.1 Single-state historical volatility models……Page 51

3.2.2 Regime switching and transition exponential smoothing……Page 53

3.3 Forecasting performance……Page 54

4.1 Engle (1982)……Page 56

4.2 Generalized ARCH……Page 57

4.3 Integrated GARCH……Page 58

4.5 Other forms of nonlinearity……Page 60

4.6 Forecasting performance……Page 62

5.1 What is long memory in volatility?……Page 64

5.2 Evidence and impact of volatility long memory……Page 65

5.3 Fractionally integrated model……Page 69

5.3.1 FIGARCH……Page 70

5.3.3 The positive drift in fractional integrated series……Page 71

5.3.4 Forecasting performance……Page 72

5.4.1 Breaks……Page 73

5.4.2 Components model……Page 74

5.4.3 Regime-switching model……Page 76

5.4.4 Forecasting performance……Page 77

6.1 The volatility innovation……Page 78

6.2 The MCMC approach……Page 79

6.2.1 The volatility vector H……Page 80

6.2.2 The parameter w……Page 81

6.3 Forecasting performance……Page 82

7.1 Asymmetric dynamic covariance model……Page 84

7.2 A bivariate example……Page 86

7.3 Applications……Page 87

8.1 The Black–Scholes formula……Page 90

8.1.1 The Black–Scholes assumptions……Page 91

8.1.2 Black–Scholes implied volatility……Page 92

8.1.3 Black–Scholes implied volatility smile……Page 93

8.1.4 Explanations for the ‘smile’……Page 94

8.2.2 The Black–Scholes partial differential equation……Page 96

8.2.3 Solving the partial differential equation……Page 98

8.3 Binomial method……Page 99

8.3.1 Matching volatility with u and d……Page 102

8.3.2 A two-step binomial tree and American-style options……Page 104

8.4 Testing option pricing model in practice……Page 105

8.5.2 Dividend yield method……Page 107

8.5.3 Barone-Adesi and Whaley quadratic approximation……Page 108

8.6 Measurement errors and bias……Page 109

8.6.1 Investor risk preference……Page 110

8.7 Appendix: Implementing Barone-Adesi and Whaley’s efficient algorithm……Page 111

9 Option Pricing with Stochastic Volatility……Page 116

9.1 The Heston stochastic volatility option pricing model……Page 117

9.2 Heston price and Black–Scholes implied……Page 118

9.3 Model assessment……Page 121

9.3.2 Nonzero correlation……Page 122

9.4 Volatility forecast using the Heston model……Page 124

9.5.2 The case of stochastic volatility……Page 126

9.5.3 Constructing the risk-free strategy……Page 127

9.5.4 Correlated processes……Page 129

9.5.5 The market price of risk……Page 130

10.1 Using option implied standard deviation to forecast volatility……Page 134

10.2 At-the-money or weighted implied?……Page 135

10.3 Implied biasedness……Page 136

10.4 Volatility risk premium……Page 138

11.1 Which volatility forecasting model?……Page 140

11.2 Getting the right conditional variance and forecast with the ‘wrong’ models……Page 142

11.3.1 Individual stocks……Page 143

11.3.2 Stock market index……Page 144

11.3.3 Exchange rate……Page 145

11.3.4 Other assets……Page 146

12.1 Basel Committee and Basel Accords I & II……Page 148

12.2.1 VaR……Page 150

12.2.2 Backtest……Page 151

12.2.3 The three-zone approach to backtest evaluation……Page 152

12.3 Extreme value theory and VaR estimation……Page 154

12.3.1 The model……Page 155

12.3.2 10-day VaR……Page 156

12.3.3 Multivariate analysis……Page 157

12.4 Evaluation of VaR models……Page 158

13.1 New definition for VIX……Page 162

13.2 What is the VXO?……Page 163

13.3 Reason for the change……Page 165

14 Where Next?……Page 166

Appendix……Page 168

References……Page 220

Index……Page 234

Reviews

There are no reviews yet.